Financial Services

- Improving Tax Collection in Developing Countries

- Economic Impact of Mobile Phone Access

- High-Tech Trading Platform for Ugandan Farmers

- Paying School Fees via Mobile Money

Researcher: David Lagakos (UC San Diego) and Anders Jensen (Harvard)

Location: Ghana

In most developing countries, tax collection capacity remains inadequately low. Nowhere is this lack more apparent than in local governments, which collect a negligible fraction of local income in taxes. As a result, local governments provide inadequately low levels of public goods—such as roads, schools and electricity—which are crucial inputs in order for developing countries to achieve structural change and economic growth.

The goal of this project is to identify the key constraints on local government tax collection capacity. We focus on the case of Ghana, which is one of the most developed countries in Sub-Saharan Africa, and a stable democracy, and yet which collects less than 2 percent of GDP in local tax revenues. The low levels of local taxation are widely acknowledged to be a constraint on growth and development by the Ghanaian government, and policymakers do not agree on how best to promote greater revenue collections.

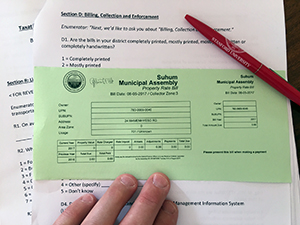

This project consists of two basic stages. In Stage I, we will build the most comprehensive database in existence of local taxation capacity in Ghana. To do so, we will begin by digitizing complete records of revenues by source as well as collection costs and administrative costs of revenue collection. We will then design a new survey instrument about tax collection practices and technologies used for identifying revenue sources, valuation of properties, enforcement of payments and tax collection strategies more broadly. We will use this survey to interview the main government officials in each of Ghana's 216 district governments, and quantify their capacity on each of the key metrics.

We will use our database to characterize "best practice" among local governments on several main dimensions: identification of revenue sources, tax collection technology usage, tax enforcement strategies, property valuation techniques, and openness to improvements in tax collection capacity and new technologies. The surveys will help inform which constraints most binding for local governments in terms of revenue collections, and which interventions will be most effective in raising local tax collections.

In Stage II of the project, we will use our findings from Stage I to conduct a randomized controlled trial on local governments, introducing a combination of new technologies and new tax collection methods, and assessing the impact on district revenue collections.