Local Incentives and Illegal Mining: The Effect of a Royalties' Law Reform

Student Researchers: Mauricio Romero and Santiago Saavedra

Location: Colombia

In this project, researchers studied a reform in Colombia that reduced the share of tax revenue allocated to mining municipalities.The reform dramatically lowered the revenue local governments receive from legal mining in their territory and consequently their incentives to report illegal mining.

In this project, researchers studied a reform in Colombia that reduced the share of tax revenue allocated to mining municipalities.The reform dramatically lowered the revenue local governments receive from legal mining in their territory and consequently their incentives to report illegal mining.

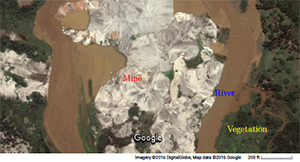

Studying tax evasion and illegal activities is difficult as, almost by definition, these activities are hard to observe and the data is often scant and unreliable. Researchers used machine learning algorithms applied to satellite data to measure illegal mining over time to overcome this obstacle.

Results

Researchers found that illegal mining increased in Colombia after the reform. Using a difference-in-differences strategy, with Peru as the control, they found that illegal mining increased by 4.47 percentage points as share of the mining area. This implies that of every dollar redistributed, 7–21 cents are lost through evasion.

Although tax evasion might not have a welfare cost if it is just a transfer of resources, researchers also documented larger negative effects of illegal gold mines on the health of newborns. These are equivalent to additional 4–13 cents on human capital costs per dollar redistributed.

The increase in illegal mining illustrates the difficulties of redistributing resources. Given the trend towards decentralized budgeting of local public goods, the results point to the importance of connecting tax revenue and spending and of monitoring illegal activity.